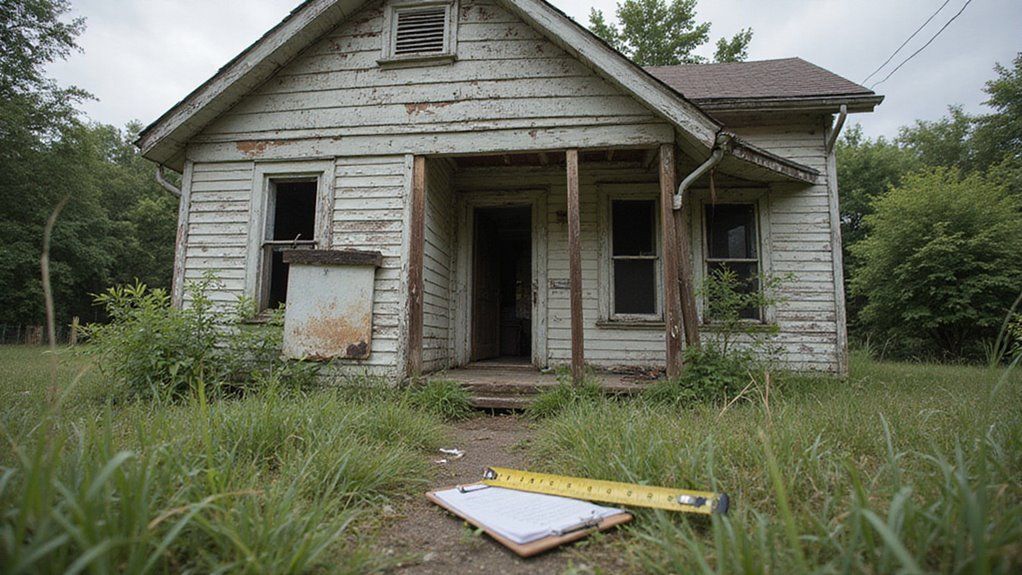

Inheriting a property through probate feels like navigating a legal maze with no map or guide. Selling such a house requires court approvals, specialized knowledge, and extensive paperwork—overwhelming even the most organized heirs. Many executors struggle with delays and unexpected costs that drain the estate’s value. Fortunately, understanding the proper steps and working with experts can simplify this complex process.

To sell a house in probate, you need legal authority as the court-appointed executor or administrator, plus court approval for the sale. The process involves filing appropriate legal documents, working with real estate professionals familiar with probate sales, and submitting all offers for court review before closing.

In this blog I will explore everything you need to know about selling property through the probate process.

Key Takeaways

- Obtain court approval by filing a petition and securing Letters Testamentary or Administration before listing the property.

- Work with a probate-specialized real estate agent to facilitate marketing and sale compliance.

- Present offers to the court for confirmation and ensure all estate debts and taxes are settled before distribution.

- Complete necessary legal documents and secure court approval during the sale process to transfer ownership legally.

- Account for costs like court fees, agent commissions, and taxes, which reduce the final proceeds received by heirs.

What is Probate and How Does it Affect Home Sales?

Probate is the legal process that manages a deceased person’s estate. It verifies their will and ensures assets transfer to proper heirs.

The court supervises the entire distribution process according to state laws. When selling a home through probate, you need court approval before completing the transaction.

The estate executor must follow specific steps. They must obtain accurate property valuation and secure formal court confirmation for the sale. This oversight protects all parties involved.

The process typically extends the timeline for home sales by several months.

Who Can Legally Sell a House in Probate?

Only court-appointed personal representatives can legally sell a house in probate. These representatives include executors named in wills or administrators appointed by courts. Their authority requires court approval before any sale can proceed.

State laws regulate the entire probate property sale process to protect all parties’ interests.

Heirs can’t sell probate property on their own. They must wait for the executor or administrator to handle the transaction. Additionally, interested parties like creditors or potential buyers have no direct selling authority. The court maintains oversight throughout the process.

The probate court must approve all sales decisions before any transfer of property can occur. This requirement ensures fair treatment for creditors and beneficiaries alike.

What Are the Types of Probate Sales?

You have two main options regarding probate sales: formal and informal processes.

Formal sales require court approval at each step and involve public bidding, while informal sales move faster with less court oversight.

Sometimes, the personal representative can even sell the property independently through independent administration, skipping much of the court process.

Formal Probate Sales Process

The formal probate process manages complex assets and resolves heir disagreements through court oversight. Court approval is required before listing any property.

An official probate property appraisal determines fair market value. The court supervises all sales, allowing competitive bidding from interested parties.

Finally, court confirmation validates the transaction and ensures proper distribution of proceeds.

This structured approach protects all parties involved. Each step follows strict legal guidelines to prevent disputes. Moreover, the court’s involvement adds legitimacy to the entire process.

Informal Probate Sales Process

The informal probate sales process allows quicker property sales with less court involvement. This option works best for uncomplicated estates where assets have joint ownership.

Court approval must be secured before listing the property. Legal compliance requirements still apply even in informal proceedings.

A probate property listing agent helps navigate this process efficiently. The timeline remains flexible compared to formal probate. This approach balances speed with necessary legal protections. Your agent will guide you through each required step.

Many sellers appreciate this streamlined alternative to full probate proceedings. The reduced court oversight often results in faster completion times.

Independent Administration

Independent administration allows executors to manage probate sales with minimal court involvement. You can handle estate assets, sell property, and make decisions without seeking court approval first. This streamlines the entire process for everyone involved.

Executors must follow specific probate real estate laws regarding fair market valuation. Nevertheless, the freedom to act independently saves considerable time. In most cases, this approach reduces the typical probate timeline by several months.

Heirs benefit from faster distribution of assets and reduced legal fees. Additionally, property can be sold at optimal market timing rather than waiting for court dates.

How to Sell a House in Probate?

To sell a house in probate, you first need court approval, which involves getting the right documents and permissions.

Then, you’ll need a professional appraisal to set a fair price before listing the property and marketing it effectively.

Once offers come in, court confirmation is required before you can close the sale and distribute the proceeds to heirs.

Getting Court Authorization

Court authorization is legally required before selling probate property. You must file a petition with detailed property information first.

Next, submit comprehensive estate property disclosure documents as required by your jurisdiction. The court may schedule a hearing where interested parties can voice objections to the sale.

The final step involves obtaining Letters Testamentary or Letters of Administration. These documents prove your legal authority to sell.

With proper authorization, you can proceed with listing the property. This process protects all heirs by ensuring the sale follows proper legal procedures.

Property Valuation and Appraisal

Licensed appraisers determine a property’s fair market value after court authorization. They assess condition, location, and review comparable sales in the area. This official valuation establishes an appropriate listing price for the estate property.

The appraisal directly impacts court approval requirements and establishes the basis for probate property taxes. Furthermore, accurate valuations protect all heirs by ensuring the property sells for a fair price.

The appraiser provides a detailed report that becomes part of the legal documentation. During this process, executors should prepare all property documents and maintenance records.

As a result, the valuation process creates transparency and reduces potential conflicts between beneficiaries.

Listing and Marketing the Property

Executors should work with specialized probate real estate agents after receiving court approval. The agent will list the property on multiple platforms to maximize visibility. They’ll arrange open houses and professional photography to attract serious buyers. Regular updates to heirs about marketing activities and offers maintain transparency.

All probate property marketing must comply with local legal requirements regarding disclosures and sales processes. Each jurisdiction has specific rules about property advertisements during probate.

Effective marketing strategies include highlighting the property’s potential and unique features. Additionally, pricing the home correctly based on current market conditions is crucial for a timely sale.

Furthermore, being prepared to negotiate with buyers who understand the probate process leads to smoother transactions.

Accepting Offers and Court Confirmation

Court approval is required for all offers on probate property. You must present any offer to the court, particularly in formal sales processes.

The law requires advertising and only accepts overbids exceeding 105% plus $500 to ensure fair asset sales.

The confirmation hearing finalizes the transaction. This process protects all heirs from unfair dealings. Courts also verify that your listing agreement follows legal requirements before approving the sale.

Throughout this process, transparency remains essential for all parties involved. After confirmation, the transaction proceeds similar to standard real estate sales.

Completing the Sale and Distributing Proceeds

The executor must submit all required documents to the court and get confirmation to finalize a probate sale. First, they need to provide the sale agreement and verify the buyer has sufficient funds.

All estate debts and taxes must be paid before any money is distributed to heirs.

Proceeds are then allocated according to the will or state law if no will exists. Clear communication with heirs prevents misunderstandings and potential legal disputes.

Furthermore, the executor should maintain detailed records throughout this process. The court typically reviews everything to ensure the executor followed proper procedures before closing the estate case.

What Are Common Challenges When Selling Probate Properties?

Probate property sales face several significant obstacles. Heir disputes and legal challenges often require court intervention and extend timelines.

Contested wills and creditor claims can halt the entire sales process until resolved. Appraisal delays frequently occur when property values become contested.

Documentation problems arise from missing titles or incomplete paperwork. Outdated homes may need substantial repairs before listing.

The emotional stress affects all parties involved in selling a deceased loved one’s property. Furthermore, local probate laws vary by state, requiring specialized knowledge to navigate correctly. These challenges increase both time and financial pressure on executors.

How Long Does it Take to Sell a Probate House?

Selling a probate house typically takes six months to over a year. The timeline depends on several legal factors including court approval processes, asset valuation requirements, and potential disputes among heirs. Market conditions also play a significant role in the selling speed.

Simple probate cases may resolve faster when all parties agree. However, complications like creditor claims or family disagreements extend the timeline considerably. Local probate laws can also impact how quickly you can complete the sale process.

Remember that patience is necessary when navigating probate real estate transactions. Each step must follow legal protocols to ensure a valid transfer of ownership.

What Are the Financial Implications of Probate Sales?

When selling a probate property, you’ll face various costs that can cut into your proceeds, like court, appraisal, and legal fees.

You also need to handle estate debts and taxes first, which could reduce what’s left for heirs.

Plus, expect expenses for executor fees and potentially higher selling costs that impact your overall gain.

Tax Considerations

Probate sales involve several key tax considerations. Capital gains taxes typically use a stepped-up basis, meaning the property’s value is reset at the owner’s death date. This often reduces tax liability for heirs.

Estate taxes apply only when total assets exceed federal exemption thresholds (currently over $12 million per individual).

Property tax assessments may change after inheritance in some states. Furthermore, if sale proceeds generate income while in the estate account, this money faces estate income taxation.

Given these complexities, professional tax guidance proves essential. Tax laws change frequently, and individual circumstances vary greatly.

Estate Debts and Liens

Estate debts and liens must be paid before heirs receive any assets during probate sales. You need to handle creditor claims first. A thorough property inspection will reveal any outstanding mortgages or liens attached to the estate.

All legal debts must be satisfied according to state probate laws before property transfers can occur.

Clearing these financial obligations prevents future legal complications for beneficiaries. The estate executor bears responsibility for identifying and addressing all valid claims.

This protection ensures beneficiaries receive their rightful inheritance without unexpected financial burdens.

In the meantime, proper documentation of all payments helps maintain transparency throughout the process.

Executor Fees and Commissions

Executors charge for managing an estate during probate. Executor fees typically range from 1% to 5% of the total estate value.

Real estate agents collect 5% to 6% commission on property sales. All fees require court approval to ensure they’re reasonable under local probate laws.

Executors must maintain detailed financial records throughout the process. These records prove all transactions were handled properly.

Furthermore, transparent documentation helps prevent disputes among beneficiaries. Courts require comprehensive accounting before finalizing the estate.

Potential for Higher Selling Costs

Probate home sales cost more than regular home sales. Court fees, appraisals, attorney services, and professional estate liquidation services quickly add up. These expenses are unavoidable when navigating the probate process correctly. The timeline also affects your bottom line.

Probate properties often take 6-12 months to sell, during which you must pay property taxes, insurance, and maintenance costs. Extended selling periods drain the estate’s resources significantly.

As a result, beneficiaries typically receive less than expected from the property sale. These financial realities should factor into your decision-making process.

Ready to Sell Your Probate Property? Contact Jay Primrose Properties Today

You can sell your probate property by contacting Jay Primrose Properties at [phone/email]. Our team specializes in probate real estate transactions. We navigate court approval requirements for you.

We handle all legal documentation and follow probate sale regulations in your jurisdiction. The process typically moves faster with professional help. Our marketing reaches qualified buyers looking specifically for probate properties.

Jay Primrose Properties works directly with probate investors when quick sales are needed.

Furthermore, we help heirs understand their options clearly. We can expedite sales while maintaining compliance with legal requirements. Contact us today to discuss your inherited property and receive a free consultation.

Frequently Asked Questions

Can I Sell My House While It’s in Probate?

Yes, you can sell your house in probate, but only if the court approves. You’ll need to get the proper legal authority, follow the process, and notify all interested parties to ensure a smooth, lawful sale.

What Mistakes Does an Executor Make?

Executors often overlook essential steps, underestimate estate value, neglect clear communication, or ignore court regulations, causing costly delays and disputes. You must stay diligent, transparent, and compliant to serve the estate and heirs with integrity and efficiency.

Why Do You Have to Wait 6 Months After Probate?

You wait six months after probate to give creditors time to file claims, settle debts, and resolve disputes. This ensures the estate’s debts are paid first, protecting beneficiaries and creating a clear, fair process for distributing assets.

How Long Does an Executor Have to Sell a House After?

In Washington, you typically have up to one year to sell a house after probate begins, but delays from disputes or legal issues can extend this period. Act promptly to serve heirs and simplify the process.

Give us a call anytime at 253-697-0007 or fill out this quick form to get started today!

Get A Fair Cash Offer On Your House

About the author

Justin Baker

Justin Baker is the founder of Jay Primrose Properties, a leading cash home buying company based in Tacoma, WA. With a passion for real estate investing, Justin has helped numerous homeowners in the Pacific Northwest region sell their homes quickly and hassle-free. Justin believes that buying and selling real estate should be a seamless process and works tirelessly to ensure that his clients have a stress-free experience. With a deep understanding of the local real estate market and a commitment to exceptional customer service, Justin has established himself as a trusted and reliable cash home buyer in Tacoma and the surrounding areas.