Listing a foreclosure property can be tricky without the right steps. Many owners face unexpected hurdles that delay sales. Issues like title problems or poor property condition can cost time and money. It’s easy to feel overwhelmed by these challenges.

These problems can quickly spiral out of control. Missed details might lead to legal issues or financial loss. Buyers could walk away if the property isn’t ready. The stress of fixing errors adds unnecessary pressure. But there’s a way to avoid these pitfalls.

Follow essential steps to prepare your foreclosure property for listing. With careful planning, you can protect your investment. This process ensures a smoother, faster sale. This blog will guide you through solving these listing challenges. Stick around for practical tips.

Key Takeaways

- Conduct a thorough title review to uncover liens or legal disputes before listing.

- Assess property condition for structural issues and estimate repair costs.

- Verify foreclosure status and history to ensure legal compliance.

- Secure financing or pre-approval for a smooth transaction process.

- Research local market trends to time the listing effectively.

What are the key steps before listing a foreclosure property?

Before you list a foreclosure property, you’ve got to tackle some critical steps to ensure a smooth process. Start by focusing on due diligence, understanding the foreclosure process, and preparing financially, while also addressing legal considerations.

These elements, along with effective marketing and listing strategies, are essential to position yourself for success. Consulting with professionals can help navigate legal and tax implications that may arise during the sale.

1. Due Diligence

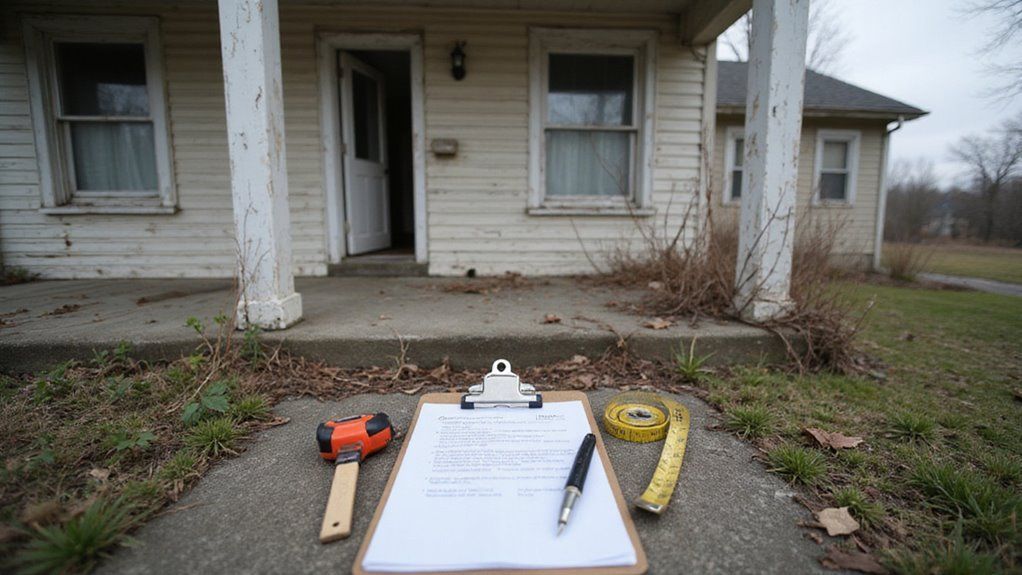

Before listing a foreclosure property, you’ve got to tackle some critical due diligence steps to ensure a smooth process. Start by conducting a thorough title review to uncover any liens or legal issues, check the property’s condition for necessary repairs, and assess the neighborhood to gauge market appeal.

These actions—title review, property condition, and neighborhood assessment—arm you with the facts needed to price and market effectively.

Title Review

A title review is a vital step in due diligence before listing a foreclosure property. It helps uncover hidden issues. Start by tracing the title’s history to find any liens or disputes. Check the ownership records to confirm clear rights. If issues arise, they could delay your sale. Don’t ignore this step; it saves time and money.

Property Condition

Carefully check the foreclosure property’s condition during your due diligence. Look for structural problems or damages that impact value. If repairs are needed, note them as they could affect pricing.

See if it has Green Certifications for energy efficiency to attract buyers. Ensure Tech Integration, like smart home systems, works properly. Addressing these issues helps you price and market the property well.

Neighborhood Assessment

Evaluating the neighborhood is crucial when assessing a foreclosure property. Check the local Art Scene for galleries and events. These can make the area more appealing to buyers. Look at nearby Dining Options as well. Trendy eateries often draw potential homeowners to the location.

Safety should be a top priority too. Investigate the quality of schools and nearby amenities. If the area feels vibrant, the property’s value could rise. Don’t ignore this step before listing your home.

2. Understanding the Foreclosure Process

Foreclosure occurs when a homeowner can't pay their mortgage, so the lender takes back the property. You must grasp this process to list such properties effectively. It begins with Pre-Foreclosure, where missed payments lead to default notices. If issues persist, it could move to Judicial Foreclosure, involving a lawsuit by the lender.

The court then decides on property seizure. Timelines and legal rules differ by state, so research them carefully. Check the property’s history to verify its foreclosure status. If you know these details, you’ll avoid unexpected issues. This preparation helps you list foreclosure properties with confidence.

3. Financial Preparation

As you prepare to list a foreclosure property, getting your finances in order is critical. Start by securing financing to cover the purchase and any immediate expenses, ensuring you’ve got the funds ready for a smooth transaction. Then, estimate repair costs accurately, so you’re not caught off guard by unexpected expenses during the process.

Financing

Financial preparation is vital to prevent delays when listing a foreclosure property. It helps you stay organized and ready.

- Get pre-approval for loans to speed up the process.

- Check your credit score to understand your standing.

- Pay off small debts if you can manage it.

- Research lenders who specialize in foreclosure properties.

- Plan a budget in case unexpected costs arise.

If you prepare well, the listing process will be smoother and faster!

Repair Costs

When preparing a foreclosure property for sale, consider repair costs in your budget. Start by assessing any damages carefully. Prioritize fixes that can increase the property’s value quickly. If damages are minor, try DIY repairs to save money. For major issues, hire professionals to ensure quality work. Research warranty options if unexpected problems arise later. This protection helps keep the property competitive in the market.

4. Legal Considerations

As you prepare to list a foreclosure property, don’t overlook the legal risks like trespassing on the property without proper authorization. Make sure you’ve got explicit permission or legal backing to access the home, as unauthorized entry can lead to serious consequences. Seek expert legal advice to navigate these issues and ensure you’re fully compliant with local laws before proceeding.

Trespassing

When listing a foreclosure property, tackling trespassing is vital to avoid legal issues. Secure the property to stop unauthorized entry. If trespassers access it, they can cause damage or delays.

Take these steps to protect the property:

- Check for weak entry points.

- Use strong locks on all doors.

- Put up clear no-trespassing signs.

- Visit the property often for monitoring.

- Lock all windows tightly.

If you ignore trespassing, your listing could face serious risks!

Legal Advice

Listing a foreclosure property can be tricky, but legal advice helps. It guides you through complex rules with ease. An attorney can protect your interests and ensure compliance. If issues arise, they prevent costly mistakes.

Seek a lawyer to review any insurance claims linked to the property. They can also explore mediation for disputes. If you face lender or tenant conflicts, this step is vital. Don’t skip legal guidance before listing.

5. Marketing and Listing

As you move into marketing and listing a foreclosure property, start by conducting thorough market research to understand local trends and set a competitive price. Develop a strong listing strategy that includes professional photography and clear, engaging descriptions to attract potential buyers. Ensure you've got a robust online presence to maximize visibility and reach the right audience quickly.

Market Research

Before listing a foreclosure property, conduct detailed market research to set the right price and attract suitable buyers. Follow these essential steps to understand the market better.

- Local economic indicators can guide you in spotting pricing trends.

- Surveys help determine if buyers are interested in the area.

- Comparable sales data shows what similar properties sold for recently.

- Neighborhood demand indicates if the location is popular among buyers.

- Market fluctuations could affect the best timing for your listing.

Listing Strategy

A solid listing strategy is vital for selling your foreclosure property fast. Research market trends to understand buyer behavior. If demand is high, list your property during peak times for better results. Create a clear Timing Strategy to catch the right moment. A strong Branding Approach can showcase the property’s best features. If done well, these steps will draw serious buyers quickly. With focus, you’ll maximize returns without delays.

Professional Photography

Great photography can boost the appeal of your foreclosure property. Hiring a skilled photographer is a smart choice. They should have experience in real estate or interior shoots to showcase your space. If you want the best results, follow these tips.

Use natural light to create a warm, inviting look.

Highlight unique features like fireplaces or modern fixtures. Stage key rooms to help buyers imagine living there. Shoot wide angles to show spacious areas clearly. Edit photos carefully for sharp, clean visuals. If you use stunning images, buyers will notice your property first!

Clear Descriptions

Crafting clear descriptions for a foreclosure property is essential. They must highlight key features and the home’s condition. If you stay honest about flaws, trust will grow with buyers. Use specific words to create a vivid image. This helps potential buyers know what to expect. Clear details can spark interest in the property. Setting realistic expectations avoids future misunderstandings.

Online Presence

Building a strong online presence for your foreclosure property can attract buyers. You must showcase it well while staying safe. If you follow key strategies, success is possible.

Use trusted real estate websites for posting your property. Include high-quality photos to grab attention fast. Write clear, engaging descriptions to highlight key features. Always protect personal details when sharing online. Respond to inquiries with honesty and respect.

If privacy or ethics are ignored, issues may arise. Stay noticed while keeping integrity intact.

Conclusion

After thorough preparation, you can confidently list your foreclosure property. If you’ve completed due diligence, you’re on track. Understanding the foreclosure process ensures a smooth listing. Financial readiness and legal compliance are key steps. A solid marketing plan will attract potential buyers

.

If challenges arise, consider alternative solutions for a quick sale. We buy houses for cash at Jay Primrose Properties. This option can simplify the process for you. It saves time and reduces stress during foreclosure.

Should you need assistance, we’re here to help with your property. Contact us at Jay Primrose Properties today. Let’s turn your efforts into success together.

Give us a call anytime at 253-697-0007 or fill out this quick form to get started today!

Get A Fair Cash Offer On Your House

About the author

Justin Baker

Justin Baker is the founder of Jay Primrose Properties, a leading cash home buying company based in Tacoma, WA. With a passion for real estate investing, Justin has helped numerous homeowners in the Pacific Northwest region sell their homes quickly and hassle-free. Justin believes that buying and selling real estate should be a seamless process and works tirelessly to ensure that his clients have a stress-free experience. With a deep understanding of the local real estate market and a commitment to exceptional customer service, Justin has established himself as a trusted and reliable cash home buyer in Tacoma and the surrounding areas.